The 2023 Federal Budget was recently announced and is bringing exciting news for the renewable energy industry across Canada. The industry welcomed the introduction of refundable investment tax credits (ITC) for renewable energy and green hydrogen investments, which will boost the competitiveness of Canada’s renewable energy industry. Here at the Hayter Group/Aecon Green Energy Solutions, we have broken down the budget and provided some highlights below regarding all things renewable energy.

As noted in the Canadian Renewable Energy Association’s (CanREA) 2050 Vision, Canada needs to increase its wind and solar energy capacity almost ten-fold to meet its commitment to achieving net-zero GHG emissions by 2050. With the support of these new investment tax credits, CanREA expects the deployment of new wind, solar, and storage to accelerate significantly compared to previous projections. The Clean Technology ITC, a refundable 30% tax credit on the capital cost of investments made by taxable entities in wind, solar PV, and energy-storage technologies, will be available from March 28, 2023, until 2034.

The Clean Electricity ITC

Also introduced was The Clean Electricity ITC is a newly announced, refundable 15% tax credit on the capital costs of investments made by non-taxable entities, such as Indigenous communities, municipally owned utilities, and Crown corporations that invest in renewable energy, energy storage, and inter-provincial transmission and other non-emitting electricity infrastructure.

The Clean Manufacturing ITC

For those in manufacturing, Budget 2023 also introduced a 30% refundable ITC for investment in machinery and equipment used to manufacture clean technology and extract relevant critical minerals, known as the Clean Manufacturing ITC. This tax credit is available for the manufacturing of renewable energy and energy-storage equipment, and the recycling of critical minerals. In addition, a refundable 40% investment tax credit on green hydrogen will start in Budget 2023.

The Smart Renewables and Electrification Pathways Program

The 2023 Budget also includes $20 billion in support for clean electricity investments through the Canadian Infrastructure Bank, at least $10 billion through the Clean Power priority area, and at least $10 billion through the Green Infrastructure priority area. The Smart Renewables and Electrification Pathways (SREPs) program will receive a total of $3 billion to support regional priorities and Indigenous-led projects.

These new investment tax credits are a necessary step toward achieving Canada’s net-zero goals while ensuring the affordability of renewable energy for Canadians. They also create new investment opportunities and stimulate job creation in the clean energy sector.

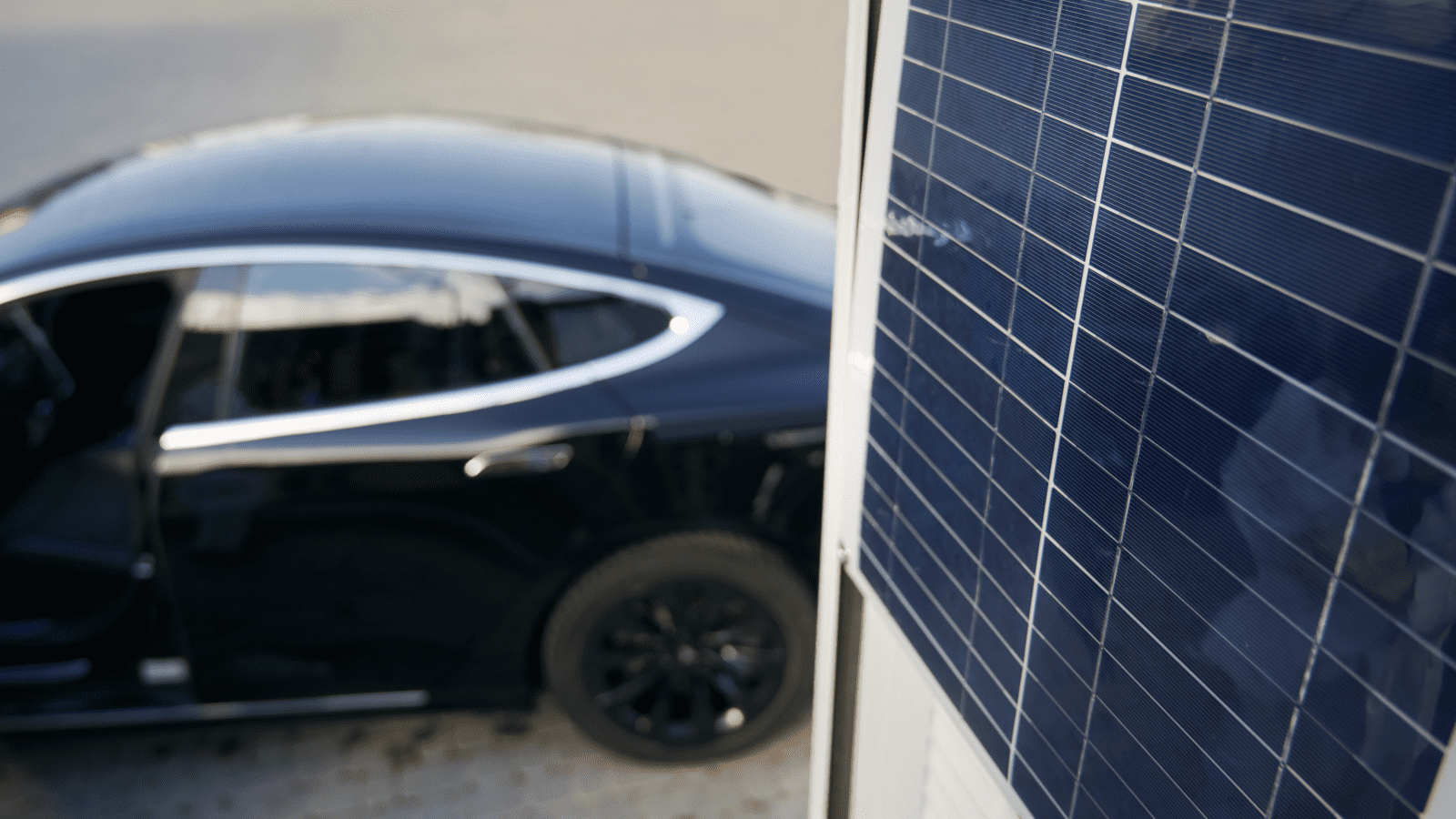

Interested in Renewable Energy For Your Home?

Are you interested in reducing your carbon footprint and saving money on your energy bills? The newly announced ITC for renewable energy could make solar a more affordable and attractive option for you. Click below to schedule your free solar assessment and see how much you could save with solar.